Destination Inspiration: How New Places Inspire Fresh Perspectives

Vernacular Flavor, Traveling Creatives and the Benefits of their Hyper-Sensitivity. Designers have a hunger. They hunger, and fervently yearn to be inspired.

FEATURED POSTS

Vernacular Flavor, Traveling Creatives and the Benefits of their Hyper-Sensitivity. Designers have a hunger. They hunger, and fervently yearn to be inspired.

FEATURED POSTS

From hospitality to energy, no industry has been immune to the economic effects of COVID-19. Design and branding, an industry which feeds all industries and is closely aligned to our own, is no exception when it comes to feeling the impact of the virus.

Filters

On a recent cold January morning, I ventured down to Cincinnati’s OTR neighborhood to attend an event hosted by UFO Performance Marketing. Aptly titled Cool

As brands move into 2026, differentiation is no longer driven by a single campaign or channel—it’s driven by the total brand experience. Leading brands are

What does a great mixtape have to do with entrepreneurship? In Simon Sinek’s interview with Jeni Britton, founder of Jeni’s Splendid Ice Creams, the

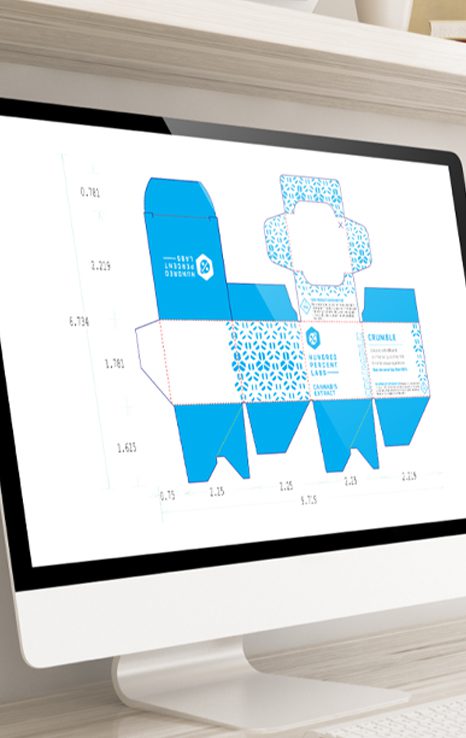

Whether you are sitting down to design your first folding carton package or your hundredth, it helps to have a pre-design checklist. This ensures that

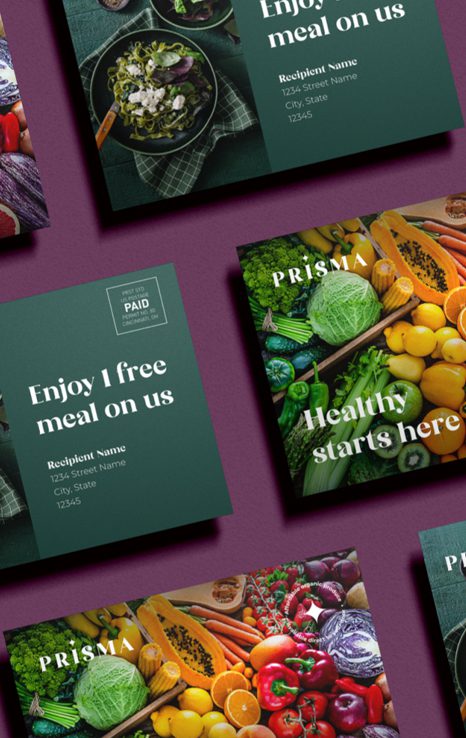

Why the smartest brands are orchestrating both mediums for stronger engagement and ROI For decades, marketers have framed the conversation as print versus digital. Digital

Ten Defining Visual Predictions that will Influence Brand Identity and Design Strategy in 2026 Design’s future is unfolding at the intersection of creativity and intelligence.